Global Office Occupancy Costs Fall

Tuesday 26 January 2010, 1:32PM

By Darroch Limited

819 views

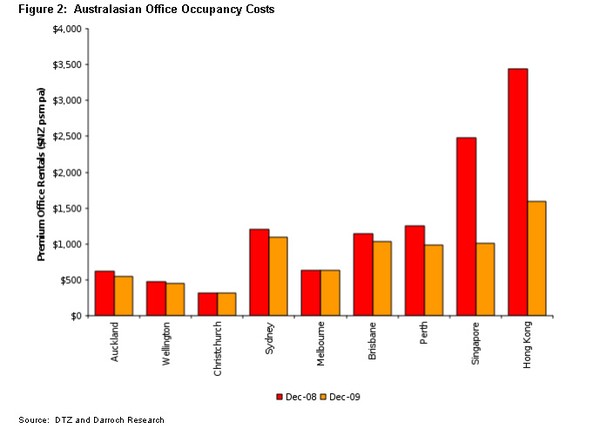

Contagion effect from US financial fallout has swept across property markets and resulted in a fall in office occupancy costs across the globe. Figure 1 presents the trend in the net percentage of office markets that experienced an increase or decrease in office occupancy costs in 2007, 2008, and 2009.

Figure 1: Net % of Office Markets Experiencing Positive or Negative Rental Growth

Source: DTZ and Darroch Research

Darroch Research (New Zealand) has received international occupancy data from DTZ who have been monitoring global trends for the last 13 years. The majority of markets around the world experienced a fall in occupancy costs during 2009. However, the expectation is the rate of decline will slow during 2010 and stabilise towards the end of the year.

The lack of available prime space has been a common trend in recent years in many office markets across most markets. Up until 2008, supply and demand imbalances led to rises in occupancy costs in many cities globally. However, the strong performance witnessed in many of these markets came to a halt in the second half of 2008, when the crisis in the financial sector started spilling over into the real economy, particularly affecting important financial centres across the globe.

In the second half of 2008, occupier demand in most markets started to weaken leading to downward corrections in rents and greater concessions to prospective tenants. The impact of declining leasing volumes on property markets became evident as the dual challenge of tightening credit and weakening economy heightened. Governments of the most affected economies led coordinated monetary and fiscal policy actions, aggressively cutting interest rates and proposing fiscal stimulus packages. Within the office sector, occupier demand (and subsequently rental levels) continued to fall as banks and financial institutions continued to downsize.

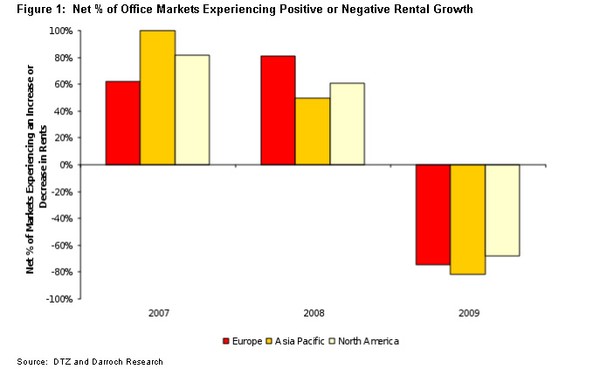

Australasian markets have not been immune from these trends. Figure 2 presents the office occupancy costs per square metre per annum in New Zealand Dollars for Australasian and Singapore and Hong Kong.

Figure 2: Australasian Office Occupancy Costs

Source: DTZ and Darroch Research

Office occupancy costs fell across the Region. Singapore experienced the largest fall in office rents globally with a fall of 51% in the 2009 year. Whereas, Christchurch was one of the better performing markets in the region with no change in rents. Other markets to experience large falls in rents in the 2009 year include Los Angles, down 44% and San Francisco down 47%. The smaller adjustment in Australasian markets reflects the extent of the initial impact on local markets.