House prices to fall over the next 12 months

Thursday 12 August 2010, 6:15PM

By QBE LMI

2,584 views

As the worst of the global financial crisis recedes, the timing of the recovery of the New Zealand housing market is still uncertain.

QBE LMI’s 2010 Housing Outlook Report prepared by Infometrics forecasts the recent tax policy changes will impact on the housing market and be a contributing factor in the forecast reduction in house prices of 4.1% by June 2011. The policy changes include;

- The removal of the ability of landlords to claim depreciation on buildings with an estimated useful life of 50 years or more

- The reduction of the top personal income tax rate from 38% to 33%

The Housing Outlook Report also identifies that cautious household spending and the prospect of further significant mortgage rate rises over the next two years will significantly influence the timing of property purchasing decisions by home buyers.

Ian Graham, CEO of QBE LMI, said “The New Zealand economy is recovering from the global financial crisis and has recorded modest growth, expanding by an average of 0.5% per quarter over the last 12 months. Sustained demand from China will underpin commodity prices and be a key factor in ensuring economic growth over the next three years”.

“Although property prices are expected to be weaker in the near term, consumer spending is expected to recover and real disposable incomes are forecast to rise by 5.6% p.a. over the next two years. The unemployment rate has also stabilised and is expected to fall to 5.3% by June 2011”.

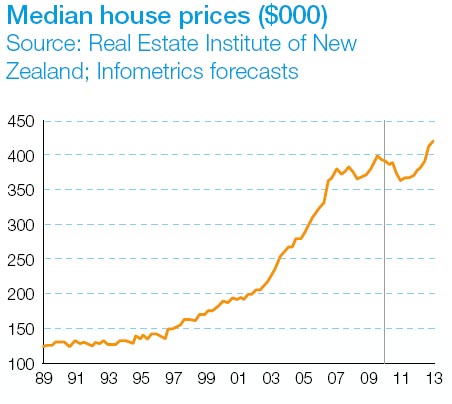

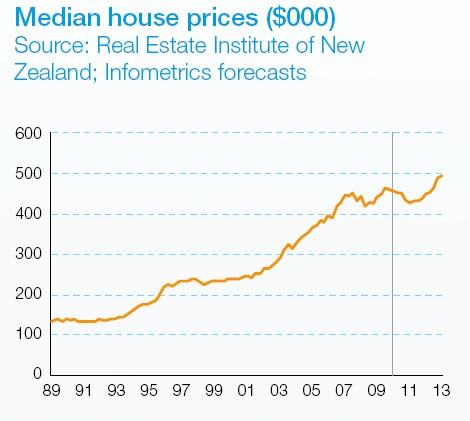

Mr Graham said “The forecast drop in house prices, combined with employment growth and an expected increase in household income will improve overall housing affordability until late 2011. This will make it attractive for home buyers to enter the housing market, particularly first home buyers. Those buyers that enter the market over the next 18 months are likely to see substantial housing price growth, with a projected lift to 10% p.a. by mid 2013”.

“QBE LMI has been supporting the New Zealand mortgage market for over 22 years, and we will continue to support home buyers and mortgage lenders as the housing market recovers. We give mortgage lenders the security and confidence to lend to credit worthy borrowers up to 95% Loan to Value Ratio (LVR) where they have the capacity to service the mortgage loan” said Mr Graham.

Regional Highlights from the 2010 QBE LMI Housing Outlook

Auckland

The Auckland housing market has recorded one of the stronger pick-ups in the country over the last year, but given the significant stock of rental property in the region, a considerable adjustment in prices is likely over the next year, with prices falling 6.4% by June 2011. With property in the region being among the most expensive in the country, rising mortgage rates are also set to have a pronounced affect on Auckland’s property market. Even with a medium-term undersupply of property, house prices in the region are likely to be relatively subdued over the three years to June 2013, rising just 8.4% (which equates to a 3.4% decline in real terms).

Wellington

Central government plays an important role in the Wellington economy, and despite a restrained fiscal position over the last year, government spending has still grown faster than private sector spending, aiding the region’s economy and property market. But a tight rein on government spending, wages, and employment is likely to limit economic growth in Wellington over the next one to two years, a factor that will be reflected in a 7.3% fall in house prices by June 2011. By June 2013, house prices are forecast to be 7% above their current level (but down 4.7% in real terms).

Waikato/Bay of Plenty/Gisborne

House prices in Waikato/Bay of Plenty/Gisborne have failed to rebound over the last year, meaning that property in the region is probably less overvalued than in some other parts of the country. Downward pressure on prices is likely to be reasonably limited over the next year, with a 2.8% fall in prices forecast. In 2012 and 2013, the effect on the housing market of high commodity prices and strong growth in export incomes will become apparent, pushing up property values. House prices are forecast to increase a total of 16% between June 2010 and June 2013 (a rise of 3.1% in real terms).

Christchurch

The Christchurch housing market is expected to perform similar to the nationwide trend over the next three years, with the mix of urban and provincial drivers providing a similar outcome for the region’s economy as for New Zealand overall. Rising mortgage rates and adjustment to the government’s tax changes are expected to lead to a 5% decline in house prices by June 2011. But economic growth is forecast to improve in 2011/12, and combined with some shortage of housing, this will contribute to a forecast 12% rise in house prices over the next three years (a 0.4% decline

in real terms).

Otago/Southland

The Otago/Southland housing market was one of the last to slow during 2008 and 2009 and has seen little rebound in house prices over the last year. However, the region’s population growth has been at unusually high levels, and with the prospect of a persistently tight labour market, strong commodity prices, and good economic growth, this population growth may be set to continue over the next three years. Over the next three years, house prices in the region are forecast to be the best-performing in the country, rising 19% in total (or 6.4% in real terms).

Taranaki/Manawatu/Wanganui

Taranaki/Manawatu/Wanganui is another region where population growth has been stronger than normal as a result of international and domestic economic conditions. The region’s population growth is likely to ease as job opportunities start to improve elsewhere, but strong export commodity prices are expected to be a dominant factor in the region’s economic performance. Healthy export incomes are forecast to boost the housing market in the region, with house prices increasing 18% between June 2010 and June 2013 (up 4.9% in real terms).

Provincial Canterbury/Westland

Higher export prices and stronger population growth have led to a rebound in house prices in Provincial Canterbury/Westland over the last year, but this lift is not expected to be sustained as higher mortgage rates reduce buyer numbers over the next year. Following a forecast fall of 3.8% in house prices by June 2011, a recovery in house prices is expected in 2012 and 2013, but the extent of this lift is likely to be limited by good availability of land. By June 2013, house prices in the region are forecast to be up 9.4% on current levels (but down 2.6% in real terms).

Nelson/Marlborough

The Nelson/Marlborough housing market has seen some lift in house prices over the last year, although this increase has occurred primarily in the Nelson area only. Over the coming 12 months, prices in the region are forecast to decline 6.9% in response to rising mortgage rates and the government’s tax changes. However, over a three-year horizon, good economic growth prospects for the region should contribute to a substantial pick-up in house prices, particularly in 2012/13. Between June 2010 and June 2013, prices are forecast to rise a total of 12% (up 0.1% in real terms).

Hawke’s Bay

The downturn in the Hawke’s Bay housing market over the last two to three years has been less pronounced than in many other regions, reflecting the fact that the market experienced less rapid price growth in 2006 and 2007, and so property in the region was not so overvalued. Nevertheless, price falls of 5.3% are forecast over the next year as population growth slows. In 2012 and 2013, strong export meat prices and improving prices for horticultural commodities are expected to boost the region’s economy and feed through into accelerating house price growth. House prices in June 2013 are expected to be 14% higher than in June 2010 (a 1.9% increase in real terms).

Northland

The Northland housing market has been weak over the last two years as the region’s economy has struggled. However, growth is forecast to improve as dairy prices hold up, the region recovers from drought, and stronger export incomes flow through into service sector expansion. Demand for holiday homes in the region is also likely to improve over the next three years. As a result of these factors, house prices are forecast to rise 18% between June 2010 and June 2013 (up 5.3% in real terms).