Industrial Land Update

Friday 13 August 2010, 2:01PM

By Darroch

735 views

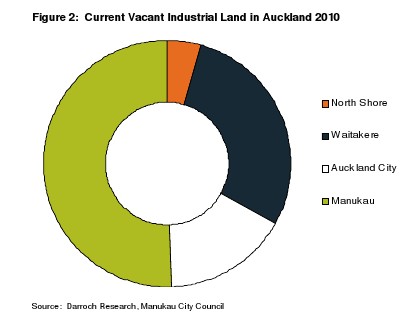

Uptake of industrial land across Auckland has fallen to its lowest level for over a decade. According to

Darroch Research’s latest industrial land survey, just ten hectares of industrial land was absorbed for new development in the year to June 2010 - down from 60 hectares in the year to June 2008. The decline in land uptake illustrates just how hard the industrial development market has been hit by the economic and property market downturn over the last three years. In North Shore, Waitakere and Auckland cities, uptake was slightly higher than six hectares, while in Manukau City, Council data shows just four hectares was taken up for development; the lowest level recorded in that city for 15 years.

A number of factors continue to constrain new development activity including; the subdued economic

recovery, volatile business confidence, tight lending controls, weak occupier demand, and rising vacancies in the existing building stock. Industrial vacancy rates across Auckland have risen over the past three years, however, that rate of increase has recently slowed. Nevertheless, industrial occupiers still have plenty of choice, mitigating the need for new accommodation. Moreover, many industrial businesses are still operating in a climate of fiscal constraint, and are unwilling to pay the much higher rents associated with new premises.

The number of new industrial building consents issued in Auckland has continued to decline over the last

year, falling from 165 in the year to June 2009 to 122 in the year to June 2010, a decline of 26%. In the

June 2005 and 2006 years, industrial building consents numbered 305 and 280 respectively, indicating

new industrial consents are now around half what they were at the peak of the cycle.

Over the last year, uptake of industrial land across all four of the major Auckland local authorities has been very weak but the Manukau result is particularly significant, given that, in the five years leading up to the 2007 credit crunch, 340 hectares of industrial land was absorbed in that city alone. Reduced demand has resulted in the re-pricing of industrial land across the region.

Weak demand for vacant land and a corresponding fall in land values is symptomatic of a post recession

market. It occurred in the aftermath of the 1987 share market crash, then again after the 1997 Asian crisis, and has happened post 2007. It forms part of the economic cycle of ‘recovery’. Downward pressure on industrial land prices has been a major factor in the market over the past 24 months. Lower land prices typically play a role in helping revive the development market. If a developer can secure land (the base cost for any building project) at a lower price, this in turn reduces the rent required to achieve feasibility. Over the last six months, despite relatively few sales, Darroch’s analyses suggest land values may be stabilising, however, it is likely to require another six months before a clearer trend emerges.

1.gif)