Housing Market Shows No Improvement

Thursday 19 August 2010, 10:09AM

By Mike Pero Mortgages

403 views

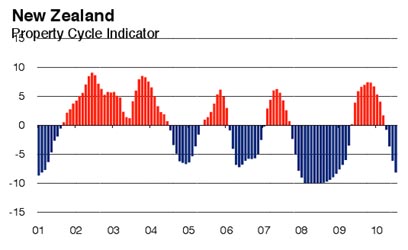

The property market continued to deteriorate in July, according to the latest Mike Pero Mortgages-Infometrics Property Cycle Indicator (PCI).

“The nationwide PCI dropped to its lowest reading last month, since December 2008”, says Mike Pero Mortgages Chief Executive Shaun Riley.

“House sales activity also remained weak in July, with sales down 27 per cent from the same time a year ago.

“The median house price continued to slide, down $3,500 from June’s result to $349,000, the lowest figure since August 2009,” he says.

The Mike Pero Mortgages-Infometrics Property Cycle Indicator fell to a negative 8.18 in July, from -6.15 in June. The Property Cycle Indicator is a sensitive measure of the housing market and includes three main factors: changes in the number of houses sold; changes in price; and the time taken for houses to sell.

The third measure of the Property Cycle Indicator, the time taken for houses to sell, showed improvement from the same time last year.

“Property took an average of 45 days to sell in July, which is up eight days from July last year.”

Auckland moved further into negative territory to -8.51 (down from -4.88 in June) and Wellington also lost ground, dropping to a PCI of -7.29 (from -4.94 in June). Taranaki slipped very slightly with a PCI of -9.64, down from -9.38 in June.

The only place to show an improvement was the South Island’s Central Otago, gaining some ground with a PCI of -4.39 in July, up from -4-54 in June. Canterbury/Westland’s PCI dropped further to -6.78 (a decrease from -5.41 in June), as did Nelson/Marlborough’s, with a PCI of -5.82 (from -5.22). Otago also lost ground slightly with a PCI of -8.25, down from -7.03 in June.

Floating mortgage rates held steady at about 6.25 per cent, but there were significant cuts to fixed mortgage rates for two to five years of between 25 and 60 basis points.