Speech: Change nothing and nothing changes – Don't Blame Greece!

David Parker, Pre Budget speech 7-30am, 22 May 2012, Pullman Hotel, Auckland

Welcome

I’m going to talk today about change.

The difference between Labour and National in New Zealand is expressed in many ways.

But the one that stands out for me is that Labour is a progressive party. The party of change. The party of the future. The party that imagines a better tomorrow.

And in contrast our opponent is a conservative party, more or less satisfied with the way things are.

Both have a proud intellectual tradition.

It’s always up to Labour to make the case for why change is needed, and why the status quo isn't working.

Why we have to discard orthodoxies that have passed their use-by date.

And why we have to be prepared to make hard decisions.

So today, I will address changes Labour believes New Zealand needs.

Because if we change nothing, nothing will change.

Before I start I want to ask, have you heard of A2 milk?

It’s a naturally occurring variant of cows’ milk which some scientists believe has properties that make it healthier than cows’ milk containing the ‘A1’ version of milk.

The Australians are drinking it as fast as they can, and it’s being launched into new markets.

A2 Corporation that markets A2 milk is an interesting example of a high value New Zealand export business that’s based on our competitive strength in agriscience.

In its last six months it turned over $28 million - $10 million more than the same period the year before.

I know a bit about the origins of the company, because I was a manager of it in its early years.

And what can we learn from the growth of a company like that one?

First, that we have to use our ideas, our science and our competitive advantage to grow.

Second, that success comes from thinking differently - really differently.

And third: success doesn’t come without change.

This is really what I want to focus on today - change.

Over the next week we’re going to be talking a lot about the budget, and about what New Zealand really needs.

I’m going to show that right now New Zealand is on the wrong course and needs to change - change to an economy that succeeds in paying its way in the world - one that will provide the jobs, growing incomes and lifestyle for all New Zealanders that Labour aspires to.

There are some hard questions at the heart of this discussion:

- Are we prepared to front up and accept there are long term deep problems we can’t keep putting off?

- Are we prepared to question orthodoxies and over-turn them when they’re past their use by date?

- And are we prepared to look into the future and do what our country really needs?

Let’s have a look at how our economy is doing.

In the last three years New Zealand’s GDP has grown just 0.6 per cent.

That’s not 0.6% a quarter, or a year - that’s the total in three years.

So that tells us we haven’t been growing in the last three years.

But then the government explains that away.

They say New Zealand’s poor economic performance is because of the global financial crisis.

Certainly we haven’t been as badly off as Europe, but I am tired of Greece and Europe being rolled out as an excuse by this government.

Because outside the Eurozone, average growth has been 1.5% a year.

New Zealand has been falling further and further behind.

The earthquakes were devastating, but economically the rebuild of Canterbury is now a source of economic growth.

Because the economy hasn’t been growing, it hasn’t been creating jobs.

Unemployment increased in the most recent survey, so that four years on, there is still little sign of a jobs recovery. Wages have not kept pace with inflation.

That’s why we’re seeing queues of one thousand five hundred people line up for 150 new jobs at a supermarket, and an Australian Jobs Expo that’s packed out with New Zealanders who have to leave to get ahead.

A thousand people a week are leaving permanently, and they’re not going to Australia because of Greece’s problems – they’re off because of New Zealand’s.

What makes New Zealand’s predicament even more pressing are our underlying structural economic problems.

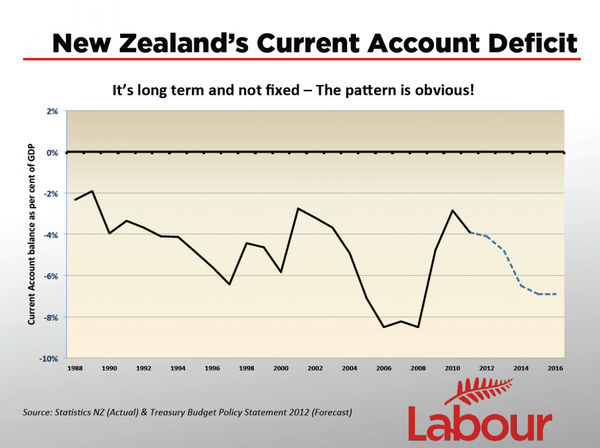

A picture paints a thousand words. I am going to show you a couple.

For decades we have spent more than we have earned as a country.

Even with the best prices for our exports in a lifetime, and imports suppressed by a recession, we have not covered the cost of our imports and interest.

Under current settings it gets worse from here.

Every year that current account deficit is funded by extra borrowing from overseas and the sale of yet more NZ assets to overseas owners.

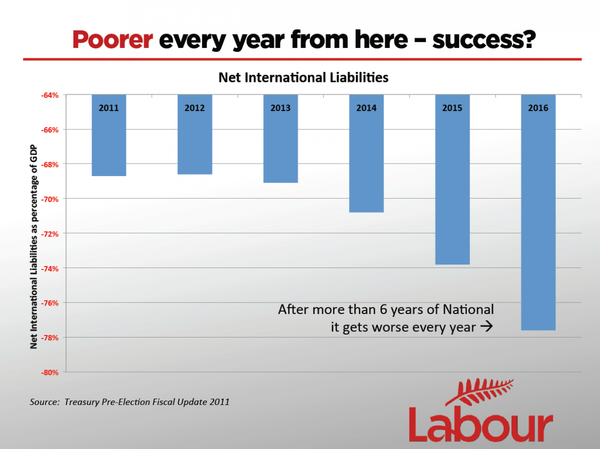

Our net international liabilities increase.

The Government keeps comparing itself to Greece, to the problems of Portugal, Spain and Ireland.

The biggest issue there is with Government debt.

New Zealand’s precarious position is caused by our private external deficit.

Our net international liabilities are amongst highest in the developed world.

Unusually for a country with high debt, it is mostly private.

Government debt here is low, in no small part because the last Labour government ran large budget surpluses year after year. Labour's philosophy was to save in a time of plenty to have reserves for the bad times. Unpopular at the time, but recent history shows it was wise.

Even though this government will limp back to surplus by 2014/15, that won’t cure our fundamental problems.

Labour would get to surplus in the same year too.

But under National what problems will New Zealand continue to have?

Our creditworthiness was downgraded at the end of last year, largely because of the outlook for our external deficit.

Treasury, the Reserve Bank and the IMF all predict New Zealand will keep spending more than we earn overseas. This means more borrowing, more debt, and more asset sales to foreign buyers.

We need to address these fundamental problems.

If the economy were a business, business leaders would understand the need for change.

Not everything in the economy can be translated into business terms - businesses don’t have to make sure that everyone in the community has a decent standard of living, and they don’t have make sure every kid has a fair opportunity.

But business leaders understand they can’t keep borrowing, or selling off capital assets and spending without bringing in revenue.

You won’t be in business for long if you don’t make hard decisions about the future, if you don't continually question your own business model, and dump practices that aren’t working.

I know this because I’ve skinned my own knees in business.

Let me take a moment to tell you about this - I started out in my working life as a lawyer.

I became a litigation and managing partner of Anderson Lloyd, the largest South Island law firm.

But I had a bit of an itch - maybe because I come from the thrifty Scottish city of Dunedin, where the need for new businesses is even more obvious than in Auckland, or maybe because my forbears on both sides of my family were self-employed.

For whatever reason, I wanted to put the commerce part of my upbringing and studies to good use and I left the law partnership to pursue a range of business interests.

In addition to my involvement in A2 Corporation, I was a co-founder and director of a group of fund management companies. I helped found BotryZen and Pharmazen. I was GM of BLIS Technologies from start up to the main board of the New Zealand stock exchange, and was involved in a variety of other businesses too.

I learned business is exciting, creative and rewards effort.

And I learned it’s easier to lose money than to make it.

I needed that legal income to pay the bills for a while.

But I learned what makes things work:

Having a clear plan for where your enterprise needs to go.

Working hard at continual improvement.

And being prepared to change when things don’t work.

I learned that tax, access to capital and regulatory settings have a profound effect on the risk profile and success of different businesses - and therefore on the balance of our economy.

These are principles that drew me to Labour’s approach to managing the economy.

It’s always Labour that makes really big changes to New Zealand’s economy.

I think that’s because we are optimists as well as realists. We want everyone to succeed, not just the few, and are not wedded to protecting the status quo.

We seek a better future, and we are tireless in trying to substantially improve things, whereas conservative parties are instinctively content with the way things are.

That’s why Labour has attracted an economic team with strong business skills.

David Cunliffe, our economic development spokesperson, is a former business consultant from Boston Consulting. They are top shelf.

Shane Jones, our regional development spokesperson is a former leader of the NZ fishing industry.

And we are led by David Shearer, who is a man of undoubted courage. David Shearer has an MBE from the British government for his humanitarian work.

He was the NZ Herald’s New Zealander of the year in 1992 and the UN promoted him to a very senior role in Iraq, with a two billion dollar budget rebuilding schools, and hospitals and power stations – testament to his undoubted abilities.

What Labour has in our economic team are people whose life experience gives us the skills to understand tough problems when we see them, and front up to them.

This is a team with senior business experience, as well as ministerial experience of our economy.

And we understand from our experience that many of New Zealand’s structural problems are caused or made worse by economic settings that only government can fix.

And we have to fix them.

Orthodoxies are hard to change.

They became orthodox with a broad consensus of support that was correct at that time.

They survive because they are comfortable and are surrounded by institutions that favour the status quo.

Those opposed to change are sometimes motivated by short term effects on them, like the relative prices of different assets, rather than the long term health of the economy:

There is always resistance to change, and this resistance means some orthodoxies are held onto after their use-by date.

It’s the same in business.

Change often entails risk.

Yet businesses that do not adapt in the face of changing circumstances decline – sometimes inexorably for long periods, but in the end they fail.

New Zealand, too, must change.

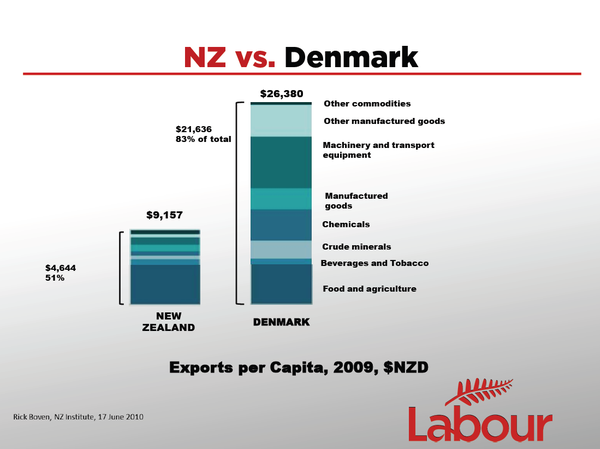

We must increase our exports to reverse our long-term decline.

This is utterly essential to our wealth and incomes.

Small, incremental and fiddly change won’t be enough

We’re going to have to be bold.

The need to change is not a consequence of the global financial crisis, although the GFC did lay bare our external deficit and related private debt problems.

The credit downgrades we suffered last year emphasised these points. It was not the fault of the Greeks.

Serious change will mean upsetting some orthodoxies.

One example is management of monetary policy.

Time and again exporting businesses say their greatest challenge is volatility in and overvaluation of our exchange rate.

Our settings are out of whack.

A former mentor and business partner of mine, the late Howard Paterson, said to me we face competitive devaluation and ignore it at our peril.

Around the world other countries are competing to increase their exports too and the dominant players are manipulating their exchange rates.

The USA is printing money, in part to deflate its dollar as it competes against the Chinese renminbi, which is set at a low rate despite enormous trade surpluses. Germany too has run huge trade surpluses on the back of a Euro held down by a currency union that has slaughtered exporters in other parts of Europe. The Swiss spent billions to curb the overvaluation of their currency.

Competitive devaluation is alive in the world.

But we operate monetary policy as if the history of the last two decades didn’t happen.

Our Reserve Bank Act was written in a time when the main economic threat was inflation.

But is there anyone who really believes it is still a more desperate economic scourge today than New Zealand’s total overseas debt? Worse than our persistent underperformance in export growth? More of a problem than our slide down the OECD rankings?

You don’t have to be soft on price stability to recognise that we have other problems to solve.

We have had four decades of external deficits, and the near total loss of local ownership of our financial sector.

Those who pretend the current orthodoxy should not be open for challenge are wrong.

I do not have the time in this speech to go into the complexities and trade-offs involved in monetary policy. There are copies of a speech I gave two years ago on the topic at the back which, if I do say so myself, still looks OK with hindsight, even if the break with the then orthodoxy was a little out there at the time.

The wider point I am trying to make is that those who pretend the current orthodoxy should not be open to challenge are wrong.

National is entitled to a different view, but to put the topic beyond consideration because they assert we have ‘world’s best practice’ is simplistic.

What is most important for business? For the government to return to surplus? yep, that's important.

Labour is committed to a thrifty fiscal track.

David Shearer has announced that until we are back in surplus, Labour would only pay for any new spending or tax cuts out of existing budget provisions, new revenue, or by re-prioritising.

Getting back into surplus in 2014-15 is a good objective.

But on its own it is not an adequate measure of economic success.

The Government cannot claim a successful economy is one that isn’t growing.

The economy isn’t a success if it isn’t creating jobs.

It isn’t a success if it isn’t growing more profitable export businesses.

And it isn’t a success if it means growing overseas debt and wages falling further behind Australia’s.

And that’s not Greece’s fault.

The economy has to grow for everyone.

It has to grow for businesses waiting for the upturn.

It has to work for the men and women who go to work each day, do their bit, and miss out on the gains. It has to work for our children coming through.

This is budget week.

For all the attention paid to the budget, I’m not expecting there will be significant change - not change capable of making a lasting difference to our growth rates.

Nothing capable of lifting our export performance.

And that’s because this Government simply won’t challenge out of date orthodoxies and they won’t take hard decisions that we know are needed.

Their economic vision has as its foremost priority selling our assets and selling our farmland.

Changing who owns what already exists won’t increase our exports.

One fundamental lesson I learned in business is that it has long been easier to make money in New Zealand from property, retail or local services than from exporting.

It’s no surprise that’s where so much of the smart money goes - at the expense of our productive export sector.

A large part of the reason we are in our current situation is because of the entrenched orthodoxies we cling on to in tax, savings and monetary policy.

So what do our exporters need?

NZ’s exporters need pro-growth tax reform.

A government has to be bold to introduce a capital gains tax.

But what we do currently is allow income from speculation in unproductive assets to be untaxed, while income from productive investment is fully liable.

And growing export businesses are starved of the capital they need. Our economy needs a Capital Gains Tax.

And if our businesses invest in research and development of innovative export products, they get no tax break.

Consequently, our private sector spend on R&D is one third of the OECD average.

If we don’t take hard decisions about pro-growth tax reform, then nothing is going to change.

New Zealanders – young and old - need better savings for their own security, to buy their own homes and to have a better standard of living in retirement.

Our exporters need the capital.

That’s one of the benefits of the improvements to Kiwisaver which Labour proposed last year.

Labour started Kiwisaver and we wanted to take it further by enrolling all employees in a universal savings scheme, with limited opt outs.

Australia, after all, has deep pools of savings capital and they are strengthening their savings scheme - from 9% of income to 12% in less than a decade.

Access to that capital is one reason the Australian economy performs better than ours. Its investors come over here and buy our companies, and their international investment position is stronger than ours.

We simply have to change.

Clinging to the current orthodoxy is safe territory for National, but it means continuing external deficits, and more overseas debt and asset sales to plug the gap.

We can’t keep putting off tough decisions.

The age of eligibility for superannuation is another example.

This budget will tinker with welfare reform, but it will ignore the most important long term fiscal pressure.

The Treasury has projected that three years from now superannuation payments will be about 20 times the unemployment benefit. Twenty times!

That’s more than all benefits combined – in fact it’s double.

Worse still - in just three years time – super costs more than total government spending on pre-school, primary, secondary and tertiary education combined. More than the total spent on all education!

What does that tell you about this government’s priorities?

The sooner the age of entitlement for superannuation is tackled, the easier the adjustment will be.

New Zealand businesses, and those who work in them, need government to do what business cannot.

National is sticking with orthodoxies past their use-by date, while New Zealanders wanting better jobs and higher incomes vote with their feet.

The reforms that are most urgent are those that will get the economy growing faster, and front up to New Zealand’s chronic problems of:

- Poor growth.

- An export sector that earns too little because it’s too narrowly based and is hampered by poor economic settings.

- Too little savings.

- Tax incentives that go to the wrong sectors.

None of what I’m talking about is about ‘tax and spend’, or ‘cutting the pie differently’ or any of the tired and out of date clichés that are hurled at Labour whenever we talk about change.

Let me tell you now what Labour’s angle of attack will be this week when the Government introduces its budget.

Our focus will be on growth – especially export growth.

The government wants the focus to be solely on fiscal management of the government deficit.

I’m saying the right place to judge their performance is their broader economic management.

Their definition of success is return to government surplus. We say that is not enough. We need an external surplus.

Our definition of success is growth in jobs, growth in the breadth of exports, growth in total exports, growth in GNP per capita.

On these measures National has failed. Failed in their economic management and failed in safeguarding our economic sovereignty.

National will claim that everything looks rosy in the out years.

But that’s what they say every year.

In 2009 the prime minster promised, “This Budget will start making the long-term changes that National promised to make and that are needed to lift New Zealand's long-term economic performance”

That budget didn’t.

In 2010 he said, “In the end, this was a Budget about growth, a Budget about jobs, a Budget about the future of New Zealand.”

Of course, there was no bold change, and no return to growth.

So last year he said it again: “The Budget is likely to see very strong growth in real wages for New Zealanders ... very strong job growth; and a much stronger economic outlook for New Zealand”

Every year they make the same promise.

And this year the same old record is playing. Last week the prime minister said the budget this year, “will show we are likely to experience reasonably robust levels of growth in 2013-14.”

It’s time to stop talking about what they say they are going to do, and start looking at what they’ve actually done. Or haven’t done.

That’s going to be Labour’s focus on the budget this week.

The growth is just not there.

Households are noticing it in an economy that never really delivers.

Budgets are perpetually stretched.

And young New Zealanders believe their future lies across the Tasman instead of here.

Fiscal fiddling isn’t going to bring them back.

Labour knows a growing economy that grows exports and grow savings, grows jobs and grows wages.

We need to shatter some big old orthodoxies.

Labour will.

I’m not in politics for the money. Few MPs are.

I have always thought the saying “the only thing worse than democracy is the alternative” is a back handed way of acknowledging that what we do is important.

Parliaments actions or omissions have a profound effect on our country. Our decisions, from education to the environment, have long term consequences.

I don’t have all the answers, but I am confident I know the important ones needed to improve our economy and environment.

Labour’s economic team has the experience of business, and of economic management to make the bold decisions needed.

To create a vibrant, innovative, cleaner exporting economy so that we can improve the lives of my children and yours, and give them more reason to stay in New Zealand.

An economy where we earn our way because of our ideas, our science and our competitive advantage.

That success will only come if we act boldly, and if government makes the changes only it can make.

Change nothing and nothing will change.

But don’t blame Greece!